China has said it will launch an official private pension scheme that aims to push more of the country’s vast household savings into the financial market, as the government grapples with an ageing population.

Employees in China will be able to contribute up to Rmb12,000 a year ($1,860) to private schemes, which the government said would be adjusted in line with “economic development” and would benefit from preferential tax treatment.

The plan, which will be trialled in certain cities for a year before being more widely implemented, is a significant moment in the government’s longstanding efforts to develop its pension system, which relies heavily on state plans and those organised by employers.

“The measures are targeted at Chinese citizen middle-class employees who are already contributors to the basic pooled pension insurance scheme, who will be newly tax-incentivised to contribute annually into an individual pension account,” said Lauren Johnston, visiting senior lecturer, with the School of Economics and Public Policy at the University of Adelaide.

“Their funds in turn will help to seed a growing Chinese wealth management and finance industry.”

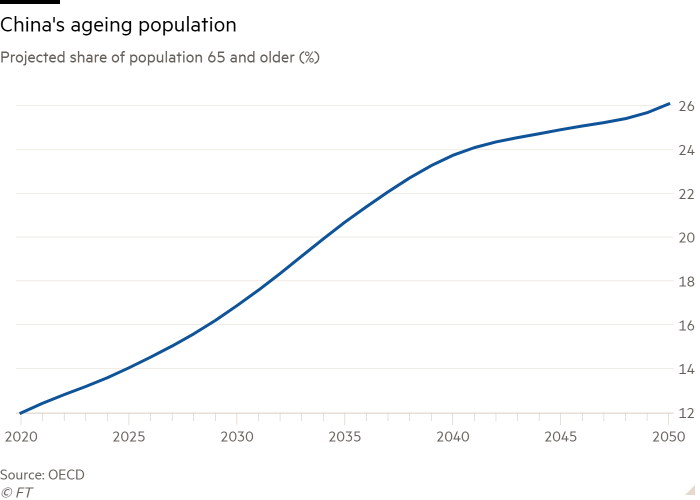

The development comes as the share of China’s population aged 65 and over has been forecast to increase more rapidly than in other OECD countries, more than doubling from 10.6 per cent in 2017 to 26.3 per cent in 2050. The share of the Chinese population aged 80 and above will rise even more quickly, according to OECD estimates, increasing more than four times from 1.8 per cent in 2017 to 8.1 per cent in 2050.

China’s approach will aim to move pension savings more directly into the country’s financial markets, as part of a wider opening up that has attracted some of the world’s biggest investors to expand their presence in the country.

Global investment giants, including BlackRock and Goldman Sachs Asset Management have over the past year launched partnerships with mainland Chinese banks as part of a bid to seize part of an asset management market with savings of almost $19tn as of 2020.

BlackRock’s majority-owned joint venture with China Construction Bank which was approved last year, said last week on its WeChat account that it would launch its first pilot pension wealth management product in the cities of Chengdu and Guangzhou. Larry Fink, BlackRock chief executive, last year said the New York-based group was “committed to investing in China to offer domestic assets for domestic investors”.

China is implementing a range of schemes that look to expand and liberalise its financial markets, including a wealth connect scheme with Hong Kong that could provide onshore investors with greater access to international financial markets. Capital controls mean Chinese household savings are largely constrained to onshore markets, where property and bank deposits are dominant.

A Towers Willis Watson report estimated that in 2020 China had $285bn in assets in pension schemes, equivalent to just 2 per cent of its total gross domestic product, though it only counted so-called “enterprise annuity” products, or voluntary pensions arranged by employers. In the UK and the US, total pension assets make up 135 per cent and 157 per cent of GDP respectively.

The development comes as countries around the world are being urged to reform their pension systems, as rapidly ageing populations strain nation’s budgets. In the 10 years to 2020, China’s population grew at the slowest rate in decades.

Earlier this year, the OECD sounded a fresh warning about the need for countries to take urgent action to ensure the sustainability of “pay-as-you-go” systems, where workers support the payment of pensions through their taxes.