On-chain data shows Bitcoin exchange reserves have now reached new 4-year lows, a sign that could prove to be bullish for the crypto’s price.

Bitcoin Exchange Reserve Has Sunk Down Further Recently

As pointed out by an analyst in a CryptoQuant post, the BTC exchange reserve has been going down, suggesting buying has been going in the market.

The “all exchanges reserve” is an indicator that measures the total amount of Bitcoin currently stored in wallets of all centralized exchanges.

When the value of this metric goes up, it means investors are depositing a net amount of coins to exchanges right now.

Such a trend, when prolonged, can be bearish for the price of the crypto as holders usually transfer their crypto to exchanges for selling purposes.

Related Reading | When Greed? Bitcoin Market Crushed Under One Full Month Of Fear

On the other hand, a downtrend in the reserve suggests investors are withdrawing their BTC from exchanges at the moment. This kind of trend can be bullish for the price of the crypto.

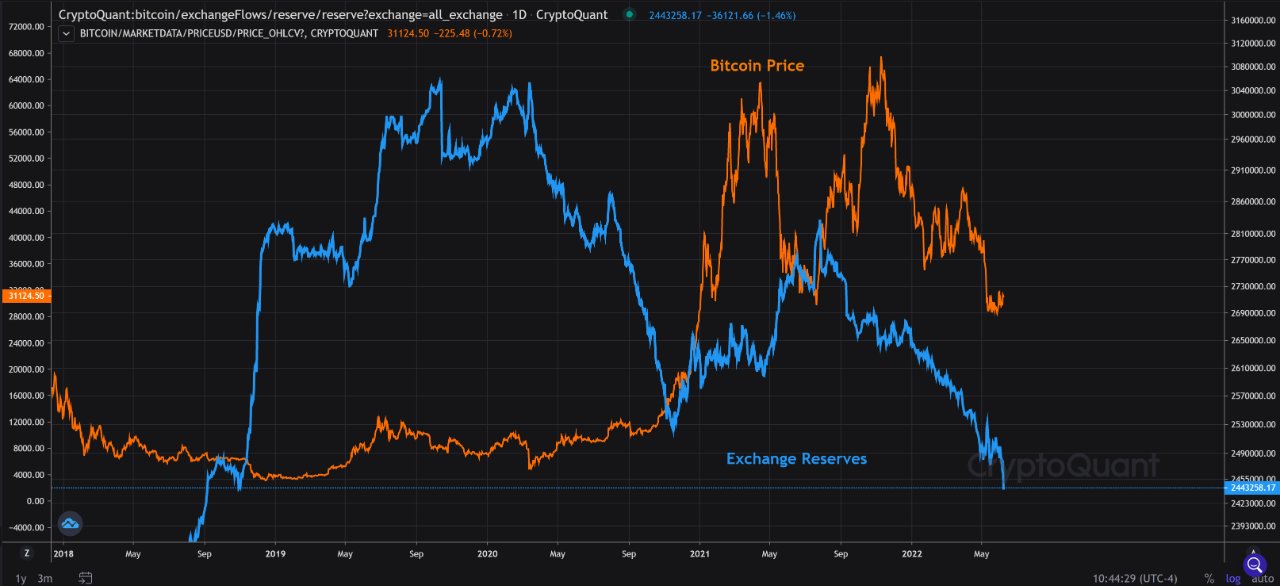

Now, here is a chart that shows the trend in the Bitcoin exchange reserve over the last few years:

The value of the metric seems to have experienced downwards movement over the last year | Source: CryptoQuant

As you can see in the above graph, the Bitcoin exchange reserve has observed some sharp movement down recently, taking its value to new 4-year lows.

This is a continuation of the overall downtrend in the indicator that has been going on for almost a full 12 months now.

Related Reading | U.S. Macro Pressure Responsible For Entire Bitcoin Downtrend

This may imply that the market has been in a state of constant accumulation, which would mean a supply shock could be deepening in the BTC market.

Due to supply-demand dynamics, such a shock can be constructive for the price of the cryptocurrency in the long term.

However, some data from December 2021 suggests that the growth of new investment instruments like ETFs are likely one of the reasons behind the exchange reserve’s decline.

The coins are simply moving from one source of selling pressure into another. Such a shift would mean that a supply shock wouldn’t take place just by declining exchange reserves.

Nonetheless, some of the decline should still be from buying in the market so a decreasing reserve can still be bullish for the value of Bitcoin.

BTC Price

At the time of writing, Bitcoin’s price floats around $30.1k, up 1% in the past week. Over the last month, the crypto has lost 12% in value.

Looks like the value of the crypto has moved sideways over the past couple of days | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com