Britain faces a protracted recession and the worst squeeze on living standards in more than 60 years, the Bank of England warned on Thursday, as it raised interest rates sharply and forecast inflation would hit 13 per cent by the end of the year.

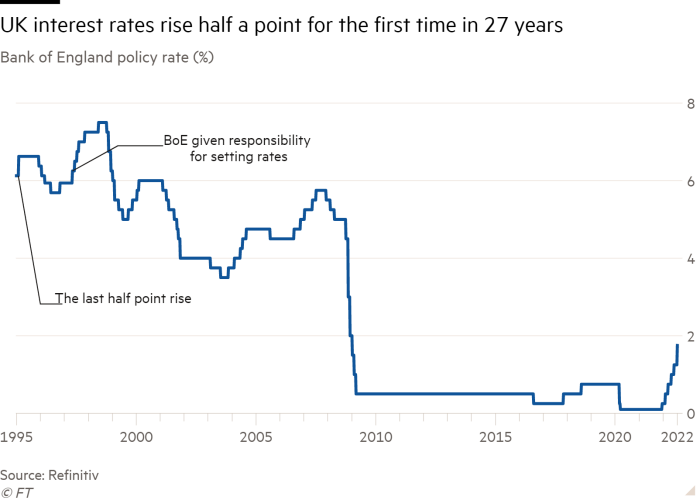

Eight of the Monetary Policy Committee’s nine members voted to raise interest rates by 0.5 percentage points to 1.75 per cent, the biggest increase in 27 years.

This follows aggressive steps from the European Central Bank and US Federal Reserve in the face of soaring inflation. Silvana Tenreyro, an external member, voted against the majority for a smaller 0.25 percentage point rise.

The BoE said that because of the latest surge in gas prices, it now expected inflation to rise above 13 per cent at the end of the year — much higher than its May forecast — and to remain at “very elevated levels” throughout 2023 before falling back to the 2 per cent target in two years’ time.

The pound slipped as much as 0.4 per cent to $1.209 after the news, while the yield on 10-year UK government bonds fell 0.07 percentage points to 1.85 per cent.

The BoE is under growing political pressure to tackle inflation after foreign secretary Liz Truss said she would look to change its mandate if she wins the Tory leadership contest and becomes UK prime minister.

With wages rising at around half the rate of inflation, BoE forecasts showed that households’ post-tax income would fall in real terms in both 2022 and 2023, even after factoring in the fiscal support the government announced in May. The peak-to-trough decline of more than 5 per cent in household income would be the worst on record, with data stretching back to the 1960s.

Even with households running down their savings, consumer spending was set to fall over the next year, said the BoE, dragging down economic growth. Its forecasts showed a much deeper contraction in gross domestic product than it forecast in May, with the economy entering recession in the fourth quarter of 2022 and continuing to shrink for five successive quarters.

A peak-to-trough fall in GDP of 2.1 per cent would be comparable to that seen in the early 1990s and the BoE said that even once the economy came out of recession, it expected growth to be “very weak by historical standards”.

The MPC said policy was “not on a preset path”, suggesting that the 50 basis point rate increase was not necessarily the first of many.

The BoE’s central forecast, which is based on market expectations of interest rates rising to 3 per cent next year, showed inflation still at double digits in the third quarter of 2023, but falling back to the central bank’s 2 per cent target a year later. If the BoE took no further policy action, its forecasts show inflation would still fall below 2 per cent by the end of 2024.

The BoE said the uncertainty around its central forecast — which assumes energy prices will follow market expectations for the next six months but then remain unchanged — was “exceptionally large” but that alternative scenarios it published still showed “very high near-term inflation, a fall in GDP over the next year and a marked decline in inflation thereafter”.

Rishi Sunak, former chancellor, said the projected surge in inflation above 13 per cent reinforced his claim that his Tory leadership rival Truss would be reckless to increase borrowing and cut taxes now.

“The Bank has acted today and it is imperative that any future government grips inflation, not exacerbates it,” he said. “Increasing borrowing will put upward pressure on interest rates, which will mean increased payments on people’s mortgages.”

Sunak’s team said the 0.5 percentage point rise in interest rates would cost the Treasury more than £6bn in higher debt servicing costs.

Truss has claimed that Sunak is partly responsible for pushing Britain towards recession, due to the series of tax rises he introduced as chancellor.