The Bank of England on Thursday lived up to its promise to act “forcefully” to curb surging inflation, by announcing the biggest increase in interest rates for more than a quarter of a century.

But while the rise in borrowing costs was no more than analysts had expected, the central bank’s intensely gloomy view of the immediate economic outlook came as a shock.

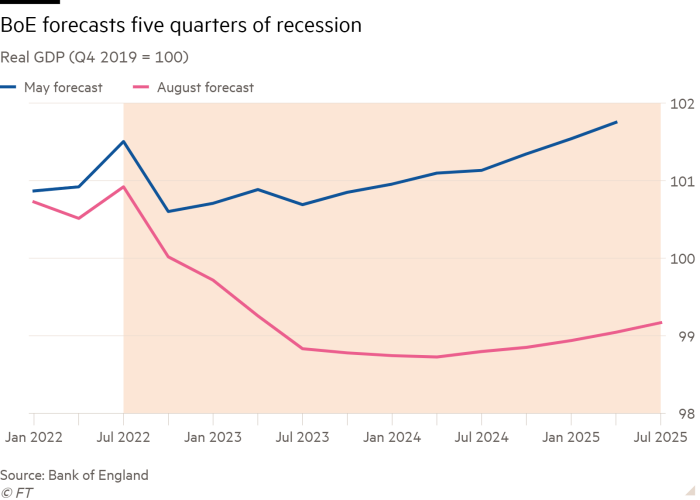

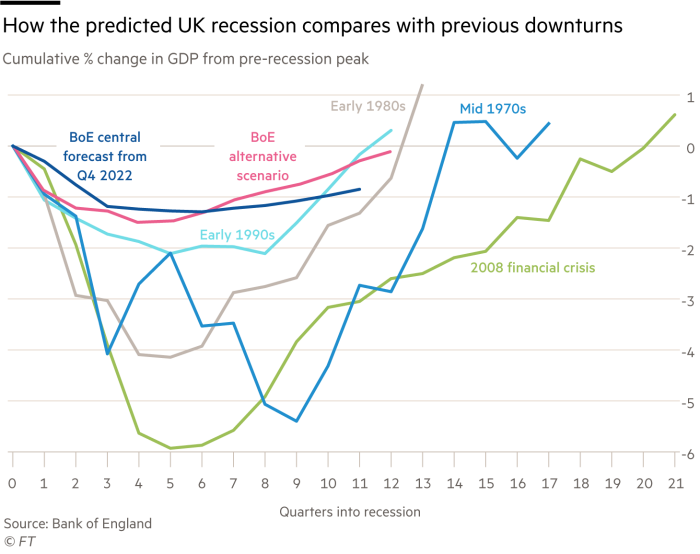

BoE policymakers have stepped up the pace of monetary tightening despite predicting a recession set to match that of the early 1990s, and the biggest fall in household incomes for more than 60 years.

Andrew Bailey, BoE governor, argued this painful squeeze on living standards was now inevitable and necessary to bring inflation under control and avoid a harsher economic downturn later.

“Inflation hits the least well-off hardest. If we don’t act now . . . the consequences later will be worse,” he said at a press conference after the BoE Monetary Policy Committee’s decision to raise interest rates by 0.5 percentage points to 1.75 per cent.

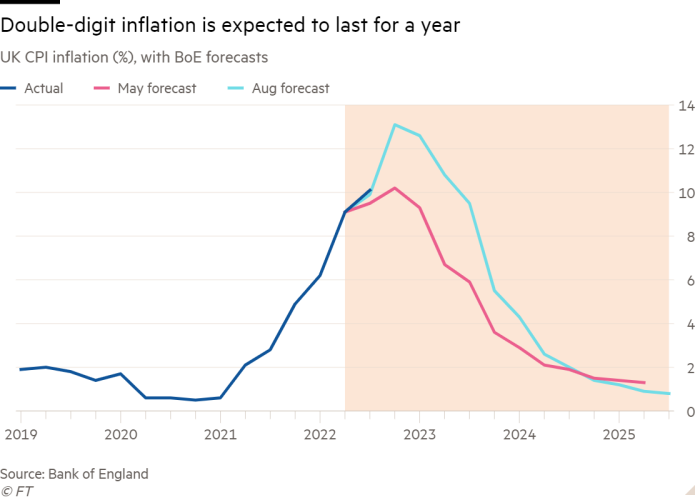

He added that despite the “very uncomfortable position” in which policymakers found themselves, “there are no ifs or buts in our commitment to the 2 per cent inflation target”. Consumer price inflation hit a fresh 40-year high of 9.4 per cent in June.

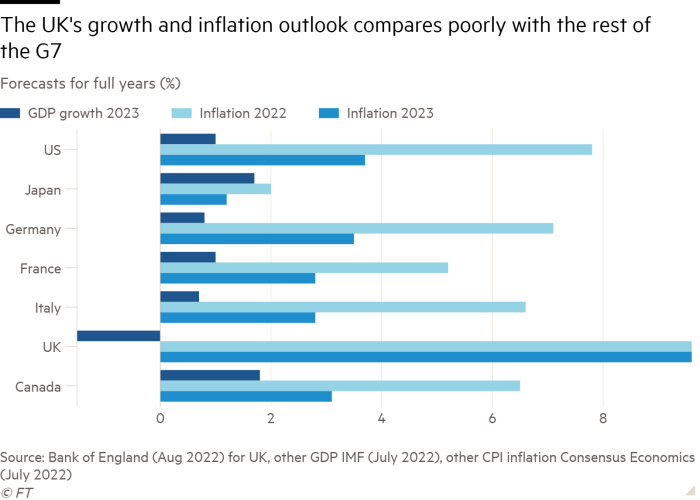

Big downgrades to the BoE’s growth forecasts are almost entirely because of the renewed surge in wholesale gas prices stemming from Russia’s restriction of supplies. Analysts said this could hit the UK economy harder than others in Europe, where governments have done more to shield consumers.

The BoE estimates a typical UK household’s annual fuel bill could now rise from just under £2,000 to about £3,500 when regulators reset their cap on prices in October — driving consumer price inflation above 13 per cent by the end of the year and keeping it in double digits for much of 2023.

“The immediate inflation outlook is now so dire that the Monetary Policy Committee feels it has no option but to engineer a more severe economic downturn,” said Ross Walker, economist at NatWest Markets, calling it a “deeply sobering shift in policy”.

But this near-term surge in inflation is not policymakers’ main concern — despite criticism levelled at the BoE by some Conservative MPs for failing to act sooner to curb price rises.

Policymakers said the inflation spike was largely because of global pressures that are already easing, with commodity prices edging down and supply chains starting to run more smoothly.

Ben Broadbent, BoE deputy governor, said the central bank could not have foreseen the war in Ukraine and could not realistically have countered its effects, even with “extraordinary insight”, given the scale of the response needed to offset such an unprecedented set of shocks.

The MPC’s bigger worry is that inflation will remain above the BoE’s 2 per cent target once these global pressures subside, if businesses and households become accustomed to prices rising rapidly and change their behaviour as a result.

“We’ve seen things which do concern us, frankly,” said Bailey, pointing to survey evidence that wage growth had accelerated since May, against a backdrop of ongoing labour shortages, while businesses still felt confident of passing on higher costs to consumers.

But the BoE thinks the looming recession will soon take the heat out of the labour market, with unemployment set to rise from the middle of next year and exceed 6 per cent by the middle of 2025.

The central bank’s forecasts suggest inflation could fall below its 2 per cent target by the end of 2024, even if energy prices remained high for longer than markets currently expect and if the BoE took no further policy action, with interest rates constant at the new level of 1.75 per cent.

Bailey said the uncertainty around these forecasts was exceptionally high, especially when it came to energy prices, and made it clear that the BoE’s aggressive action on Thursday should not be taken as a signal that it would now embark on a pre-determined series of rapid rate rises.

“Policy is not on a preset path, and what we do this time does not tell you what we’re going to do next time,” he said. “All options are on the table at our September meeting and beyond.”

One step the BoE does plan to take in September is to start monthly sales of the £875bn of assets accumulated under its quantitative easing programmes — with steady disposals aimed at reducing the stock by about £80bn over the first 12 months. But the BoE made it clear that interest rates would remain its main tool for adjusting monetary policy.

Analysts said the BoE’s forecasts suggested interest rates might need to fall over the longer term, even if the MPC thought it necessary to tighten policy further in the near term to bring inflation in check.

“Overall the bank is forecasting stagflation and suggesting that in the near term, the medicine is the tough love of higher interest rates and that further ahead the comfort blanket of interest rate cuts may be needed,” said Paul Dales at the consultancy Capital Economics.

But Sandra Horsfield, economist at Investec, noted the BoE’s forecasts did not factor in any of the fiscal stimulus both candidates for the Conservative party leadership had proposed — and that tax cuts, or other political choices, could affect the outlook “materially”.