This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Good evening

Never has the subject matter of a Nobel Prize been more apt than today’s award to former Fed chief Ben Bernanke and colleagues for their work on the role of banks in the economy and financial crises.

The announcement comes as the annual autumn meetings of the World Bank and IMF get under way in Washington DC at a perilous moment for the global economy. War in Ukraine, a serious energy crisis, rising interest rates, soaring food prices and a fracturing relationship between the world’s two biggest economies follow more than two years of damage wrought by the pandemic.

IMF chief Kristalina Georgieva has already warned that the global economy would feel like it was in recession next year from “shrinking real incomes and rising prices,” suggesting the fund will downgrade its forecasts again this week.

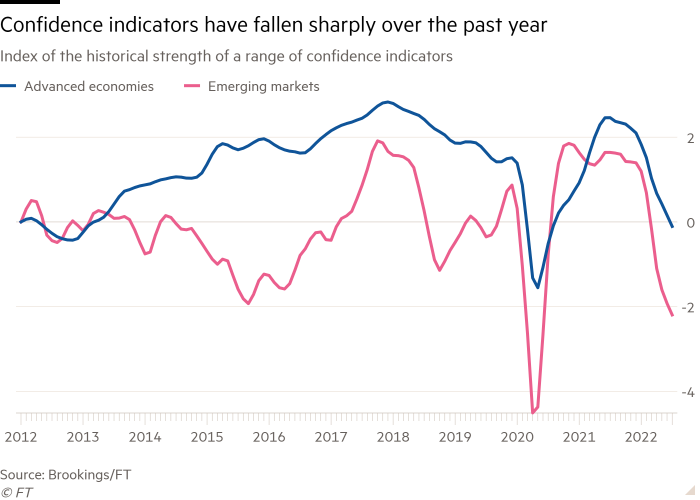

Business and consumer confidence is diving. According to new data from the twice-yearly Brookings-FT tracking index, pessimism is mounting in the face of surging prices and geopolitical uncertainties.

Meanwhile policymakers across the world continue to scramble for solutions to the energy crisis.

While Europe hunts for alternatives to Russian gas (as we report in Europe Express for Premium subscribers), relations between the world’s leading oil producers are under strain after the Opec+ group decided to cut production to raise prices (here’s our explainer if you’re late to the story). The US has accused the cartel of aligning with Russia, but analysts have warned that President Joe Biden has few meaningful options to lessen the impact of the historic cuts.

The transition to clean energy is going to be another big issue in DC this week, with the US and Germany leading calls for the World Bank to be more responsive to developing countries’ needs. (You can read more on the move to renewable sources in our new special report: Managing Climate Change.) Climate change and rising costs of inputs such as fertiliser are also reshaping global agriculture, as our Big Read details.

The US meanwhile is at loggerheads with China over tech exports. Shares in top Chinese chipmakers lost $8.6bn in market value today after Washington on Friday announced new controls to limit Chinese companies’ attempts to develop new technologies with military applications. The move will slow their progress in artificial intelligence by making it extremely difficult for them to obtain or manufacture advanced chips.

The Washington meetings could also throw up some potentially uncomfortable moments for the British contingent.

Chancellor Kwasi Kwarteng was criticised by the IMF for his recent “mini” Budget and its “untargeted” package of tax cuts, while Bank of England chief Andrew Bailey faces intense scrutiny as the BoE prepares to end its emergency backstop support for government bonds on Friday.

Latest news

For up-to-the-minute news updates, visit our live blog

Need to know: the economy

The Bank of England announced measures to stave off rushed asset sales by pension funds while chancellor Kwasi Kwarteng brought forward his much-anticipated debt-cutting plan to October 31 in an attempt to reassure jittery markets. The latest warning about the economic downturn came from retailers in London’s West End, although they may get some solace from the recent cut in VAT for overseas shoppers.

Latest for the UK and Europe

A German commission of experts outlined a €91bn energy aid package which included paying all households’ gas bills in December and subsidising residential and industrial gas prices for more than a year.

France, Europe’s biggest power exporter, reassured the UK that it could maintain electricity flows over the winter.

The UN-backed deal enabling Ukraine to export millions of tonnes of wheat is under strain from a backlog of cargo ships waiting to sail to or from the country’s ports.

Demographic changes, Brexit, and a surge in support for pro-unity Sinn Féin on both sides of the border has led to increased backing for the unification of Ireland, reports Jude Webber.

Global latest

Recent employment data suggest the hiring frenzy in developed economies is starting to ease as employers worry about rising costs and a darkening economic outlook.

Dimming economic prospects and the end of the low-interest rates era is also putting pressure on global property markets. Falling sales numbers and stretched affordability could herald painful price corrections in the UK, US and elsewhere. Buyers and sellers in the UK have been hit particularly hard by the fallout from the “mini” Budget.

Global Business Columnist Rana Foroohar reads the runes on neoliberalism and trickle-down economics, a theory that has become “political Kryptonite”. While Washington has yet to develop a fully articulated industrial policy, there are clear signs that laissez-faire economics is over, she argues.

The FT Editorial Board called for a new model of Chinese growth where consumers were empowered to spend more and save less.

Need to know: business

Wall Street banks and other big US companies have drastically cut back expectations for third-quarter earnings as fears mount over rate rises and a deteriorating economy.

Cathay Pacific, one of the biggest business casualties of Hong Kong’s strict lockdown rules, said normal levels of flying would not return for at least two years.

Aerospace and defence has been a rare bright spot for UK manufacturing in recent years but is coming under increasing pressure as it falls prey to foreign takeovers as well as being faced with rising inflation and interest rates and a weakening pound.

The World of Work

The UK hospitality sector, which has lost 121,000 EU workers in the past two years, is increasingly turning to older workers to plug the gaps in the labour market. Staff aged 50 and above now account for a quarter of the 2.2mn-strong workforce.

Brexit aside, one of the key drivers of UK labour shortages is a shrinking workforce. Some half a million people have dropped out of the workforce since the pandemic because of chronic illness and mental health problems, reports John Burn-Murdoch.

A rapidly changing labour market means skills are more important than ever. A skills-first hiring approach, rather than focusing on education and past experience, can pay a handsome dividend, writes Sophia Smith, editor of our Working It newsletter.

Covid cases and vaccinations

Total global cases: 614.1mn

Total doses given: 12.8bn

Get the latest worldwide picture with our vaccine tracker

Some good news …

Glaswegian arts centre SWG3 has launched a pioneering energy system, harnessing body heat from dancers which can be stored and used to heat or cool the venue.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you