This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

Israel is facing a political crisis with Benjamin Netanyahu’s hardline government on the end of a growing backlash against its plans to overhaul the judiciary. Netanyahu sacked his defence minister for urging a delay, while flights were grounded, shipments halted and banks were shut as protests escalated.

-

The ruling Scottish National party elected health secretary Humza Yousaf as its new leader and presumptive first minister of Scotland to replace Nicola Sturgeon, who announced her resignation last month.

-

Vaccine maker BioNTech forecast a worse than expected dip in revenues this year as demand for coronavirus shots wanes, highlighting the challenges facing companies that enjoyed windfalls from the pandemic. Revenues from Covid-19 vaccines are expected to drop to about €5bn in 2023, compared with €17bn in 2022 and €19bn in 2021.

For up-to-the-minute news updates, visit our live blog

Good evening.

The turmoil in the global banking sector may have calmed but its consequences — whether on the global economy, business, investors or the future of regulation — could have a lasting impact.

The World Bank said today that if the current run of financial news sparked a recession, it could contribute to a lost decade of growth for the global economy. It follows a warning from IMF chief economist Kristalina Georgieva at the weekend of increased risks to financial stability and the need for vigilance following the upheavals, which have added to challenges related to the pandemic, the war in Europe and the global surge in inflation.

In the UK, the boss of insurer Legal & General said the banking turmoil would hit the government’s levelling up programme by making lending more difficult and affecting the supply of new affordable housing.

From an investment point of view, the disruption is likely to have hastened the end of rapid rises in interest rates as well as boosted safe havens such as gold.

Victims of the collapse of Silicon Valley Bank in the US, which sparked the recent problems, range far beyond the tech sector, where it played a pivotal role in lending to industries such as winemaking. Start-ups have been left with a giant funding hole: SVB was responsible for a tenth of all venture debt issued in the US this year, and in its home state of California the bank was behind more than 60 per cent of all deals this year.

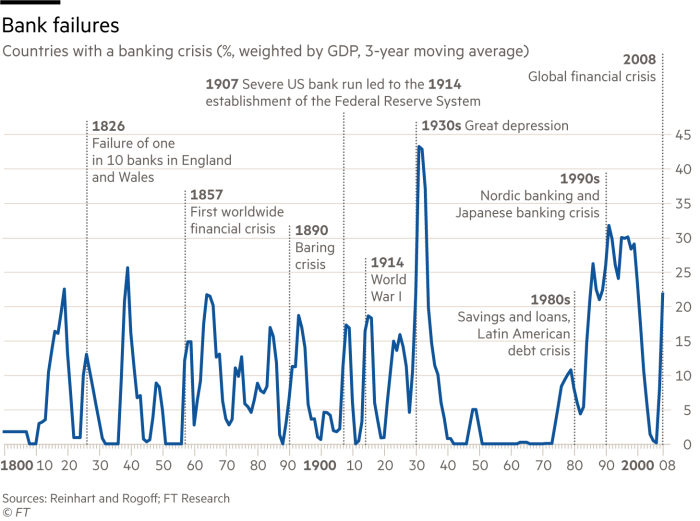

The biggest focus, however, is on banking itself. Bank runs are nothing new, the Lex column (for premium subscribers) reminds us, as it draws parallels with past crises and how they often lead to business cycle downturns.

The current troubles have also put regulations back in the spotlight.

Switzerland’s finance minister Karin Keller-Sutter — who was at the centre of the rush to rescue Credit Suisse last weekend — said the rules for winding up big banks did not work, and that following emergency protocols at the centre of the regulatory architecture “would have triggered an international financial crisis”.

Bosses in the City of London, meanwhile, are bracing for tighter oversight, even as the UK government said it would push ahead with its rule changes known as the Edinburgh reforms, widely seen as an easing the post-financial crisis restrictions. There could, however, now be more pushback from regulators and from the Bank of England, whose governor Andrew Bailey has already warned against City deregulation.

Ruchir Sharma, FT columnist and chair of Rockefeller International, says governments are making problems for themselves with a culture of bailouts and state support, which bloat and thereby destabilise the global financial system. “The past few decades of easy money created markets so large — nearing five times larger than the world economy — and so intertwined that the failure of even a midsize bank risks global contagion,” he writes.

Intervening in bank runs can limit the damage, Lex says, but it also dilutes the incentive to guard against financial risks. “No wonder many financial regulators pay close attention to history,” it concludes. “Their tools and understanding are more sophisticated than in the past. But the underlying dilemma is not much changed.”

Need to know: UK and Europe economy

Martha Lane Fox, “dotcom dinosaur” and new president of the British Chambers of Commerce, warned that businesses were holding off big decisions because of political and economic upheavals. “People just don’t feel like taking risks, investing or thinking about international trade when they’re still feeling anxious about the political situation and the economy,” she said.

Russia has adopted China’s renminbi as one of the main currencies for its international reserves, overseas trade and even some personal banking services. Moscow’s pivot towards China follows the freezing of $300bn of international assets and moves to exclude its main banks from global markets.

Need to know: global economy

Kunshan, a county in eastern China known as an exports powerhouse, is suffering a slump as global demand wanes and tensions with the US push groups to relocate production overseas. New data today highlighted the fall in China’s industrial profits, while the new head of AP Møller-Maersk, the world’s second-largest container shipping group, said the country’s economic rebound was weaker than expected.

Iraq is being rocked by a currency crisis, highlighting the fragility of its oil-dependent economy. The country’s authorities in November implemented tough rules to stamp out money laundering and cash flowing abroad, but this has had the unintended consequence of cutting the supply of dollars.

Need to know: business

Alibaba founder Jack Ma has returned to China in a rare public visit that Beijing hopes will help reinvigorate confidence for entrepreneurs after a bruising period of pandemic restrictions and regulatory crackdowns.

Investors have poured cash into US money market funds over the past two weeks as the banking upheavals sparked concerns about the safety of bank deposits. Goldman Sachs, JPMorgan Chase and Fidelity are the biggest winners.

Swedish start-up Northvolt is in talks to secure more than $5bn of financing to pursue its goal of becoming Europe’s biggest battery manufacturer. Although European industrial groups have criticised the EU’s response to US green subsidies, battery makers have been more welcoming.

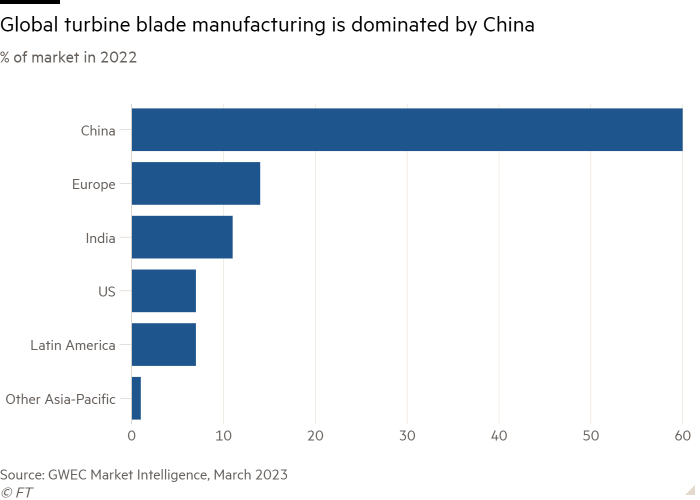

The global wind sector is set to be squeezed by bottlenecks for key components and ships, with spare capacity “likely to disappear by 2026”, according to an industry body. Much of the sector’s supply chain is concentrated in China.

“We’re out of ammunition because of too many cat videos” may be a phrase unlikely to be heard on the battlefield, but one unintended consequence of a new data centre for TikTok in central Norway is that it is using up all the area’s spare electricity and hurting production at Nammo, one of Europe’s largest makers of ammunition.

The world of work

A growing number of US states are passing pay transparency laws — and sparking a flurry of disputes about disparities as workers find out for the first time what their colleagues are earning.

If chief executives didn’t define themselves so completely by their work, retirement would be less frightening. Margaret Heffernan, author of Uncharted: How to Navigate the Future, discusses succession planning.

Increases in UK life expectancy have stalled, focusing attention on proposed changes in the retirement age, the Lex column notes.

FT Alphaville runs the rule over a new report from Goldman Sachs on the effects of artificial intelligence on the job market. In haiku form (you’ll have to read the note) it boils down to this: AI’s job impact, Productivity growth raised, A workforce displaced.

Some good news

A new water treatment developed at the University of British Columbia can remove “forever chemicals” from drinking water for good. Formally known as PFAS (per-and polyfluoroalkyl substances), forever chemicals are a large group of substances that make certain products non-stick or stain-resistant.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you