A $1tn US government borrowing spree is set to increase the strain on the country’s banking system, as the Treasury department seeks to rebuild its cash balance in the aftermath of the debt ceiling fight.

The debt ceiling stand-off between the Biden administration and Republicans in Congress, which was resolved last week, prevented the government from increasing its borrowing. The Treasury will now seek to rebuild its cash balance, which last week hit its lowest level since 2017.

But economists warn that the scale of short-dated Treasury bills the US government plans to issue before the end of the year — estimated at $1.1tn by JPMorgan — will push up the yields on government debt and suck cash out of the banking system.

“Everyone knows the flood is coming,” said Gennadiy Goldberg, a strategist at TD Securities. “Yields will move higher because of this flood. Treasury bills will cheapen further. And that will put pressure on banks.”

Yields had already begun to rise in anticipation of the increased supply, putting pressure on bank deposits which have fallen this year as the rise in interest rates and the failure of regional lenders have sent customers seeking higher-yielding alternatives.

Here’s what else I’m keeping tabs on today:

-

Economic data: The Commerce Department is expected to report the US trade deficit widened to $75.2bn in April from a $64.2bn deficit the month before.

-

Monetary policy: The Bank of Canada announces its latest interest rate decision.

-

Results: Consumer goods group Campbell Soup Co reports results.

Five more top stories

1. The OECD predicts growth in the global economy will slow this year compared with last year in its latest outlook released today. Read an interview with the OECD’s chief economist Clare Lombardelli, who calls on governments to get their finances in better shape.

-

Chinese economy: Exports contracted more than expected last month on weaker global demand for the country’s goods.

-

Eurozone economy: Economists expect official growth figures to be downgraded to show output slightly contracted for the past two quarters.

2. Antony Blinken will travel to China this month, in the latest sign that the turbulent relationship between Beijing and Washington is beginning to stabilise. The US secretary of state had abruptly cancelled a trip in February in response to a suspected Chinese spy balloon’s flight over the US. Read the full story.

3. Evacuations and rescue operations continued in southern Ukraine after the destruction of the Kakhovka Dam. In his nightly video Volodymyr Zelenskyy repeated his belief that Russian forces occupying the dam had deliberately blown it up from inside. Read more on the evacuation of residents.

4. The Securities and Exchange Commission followed up its charges against Binance and its chief executive Changpeng Zhao with a lawsuit against the cryptocurrency exchange Coinbase. The twin cases mark the SEC’s most aggressive legal assault on the digital assets market yet.

5. Saudi Arabia-backed LIV Golf and the US-based PGA tour announced a stunning merger yesterday, marking the end of a feud that has deeply divided men’s professional golf. The head of Saudi Arabia’s sovereign wealth fund and PGA Tour commissioner Jay Manahan explained to the Financial Times how the unlikely deal was brokered.

The Big Read

A damaging profile of CNN’s chief executive Chris Licht published in the Atlantic magazine on Friday went off like a bombshell in the US media industry. It depicted Licht as thin-skinned, isolated and struggling to find a strategy to reverse CNN’s sharp ratings decline. It also hastened the arrival of David Leavy, the struggling network’s incoming chief operating officer.

We’re also reading . . .

-

An ‘Asian century’?: What is really happening is the rebalancing of the world as European and American hegemony dwindles away, writes Martin Wolf.

-

‘We’re taking a militant approach’: President of the Teamsters union Sean O’Brien is preparing to negotiate between delivery service UPS and its 340,000 US-based drivers and is threatening strike action if an agreement is not reached.

-

US ‘war on woke’: An insurance sector green alliance has disintegrated in the face of an American backlash, emphasising the need for climate collaborations to adapt, writes Helen Thomas.

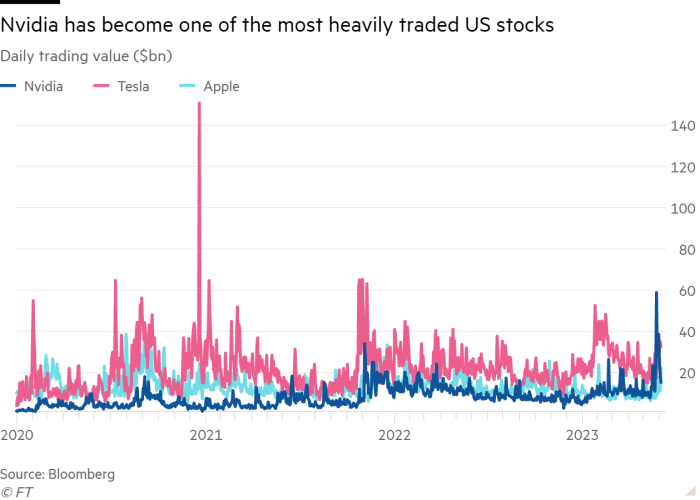

Chart of the day

Big money managers including State Street, Fidelity, Amundi and mutual funds had all cut positions in Nvidia earlier this year, missing out on the eye-watering rally that recently pushed its valuation to $1tn. They’ve spent the past two weeks catching up, racing to amass shares of the US company that has become a go-to bet on artificial intelligence.

Take a break from the news

Additional contributions by Tee Zhuo and Benjamin Wilhelm