Receive free Global economic growth updates

We’ll send you a myFT Daily Digest email rounding up the latest Global economic growth news every morning.

Central banks should hold interest rates at their current high levels or raise them further to defeat inflation, the OECD said, despite “increasingly visible” signs of economic strains and protectionism across the world.

The Paris-based organisation representing rich nations on Tuesday said it was necessary to see durable progress in defeating inflation, before considering easing monetary policy.

The advice comes ahead of crucial decisions this week by the US Federal Reserve, which is expected by economists to pause rate rises for the second time this year on Wednesday, and the Bank of England, which is forecast to raise rates for the 15th consecutive meeting.

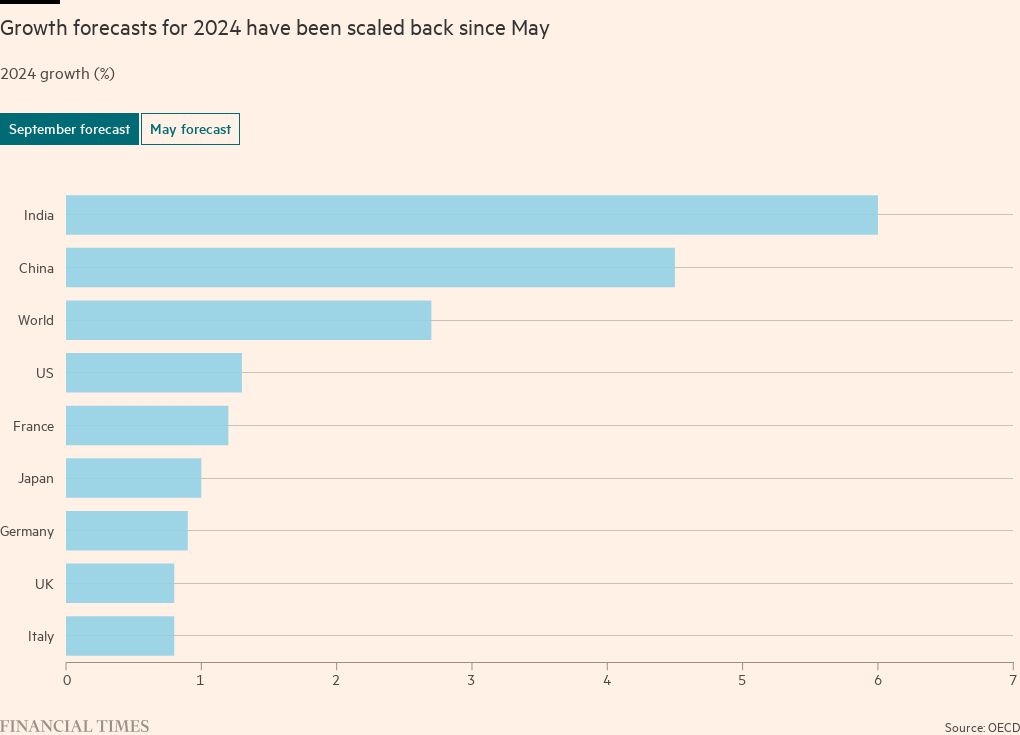

In its interim economic outlook the OECD downgraded its forecasts for 2024, saying, “the impact of tighter monetary policy is becoming increasingly visible — business and consumer confidence have turned down, and the rebound in China has faded”. It also warned the wave of protectionist measures was hurting global trade.

But Clare Lombardelli, its chief economist, said that even in the US where the evidence on inflation was “looking more positive”, it was still “far too early to declare victory” in the battle to tame price pressures and cut rates.

The OECD recommended the Fed hold rates at the current 5.25 per cent to 5.5 per cent range until the second half of 2024, while the European Central Bank and BoE tighten policy further.

Lombardelli told the Financial Times that central banks should wait until many indicators — including headline inflation, core inflation, wage pressures and corporate pricing behaviour — cooled before taking their feet off the economic brakes.

But signs that higher rates were restricting economic activity were increasing, the OECD said. Forward-looking interest rates after adjusting for expected inflation were now in positive territory in most countries apart from Japan, with business surveys trending down and financial conditions tightening.

With bank lending slowing sharply in Europe, “even if policy rates are not raised further, the effects of past rises will continue to work their way through economies”, it said.

But there had been signs, such as the 25 per cent increase in oil prices since May, which had taken the benchmark Brent crude near $95 a barrel, that not all inflationary pressures were easing.

The OECD forecast a slowdown in Chinese growth, with the rate falling further below Beijing’s official target of “about 5 per cent” in 2024. A more rapid slowdown in China would have significant spillover effects in the rest of the world, it warned.

A 3 per cent drop in domestic spending in China would transmit directly through trade to Asian economies and commodity exporters, while the US and Europe would be hard hit only if there were significant drops in global equity prices and investors demanding higher lending rates.

If there was a combined China economic and wider financial shock, that would knock more than a third off global growth, the OECD estimated.

The organisation said the most effective action economic policymakers could take to boost growth in the short term was to remove some of the barriers to trade that have been recently erected.

It said the slow recovery of global goods trade in the post-Covid-19 period had stunted growth in productivity and prosperity levels.

“It’s right that people are concerned about security, but you don’t need to reduce trade to increase resilience,” Lombardelli said.