Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

As the US Federal Reserve, the European Central Bank and the Bank of England prepare for their final monetary policy meetings this year, speculation continues that the rate-lifting cycle that has dominated since Covid-19 lockdowns and Russia’s invasion of Ukraine is not only over, but could be reversed in 2024.

However, economists have warned that the BoE faces a tougher job than its peers in reducing consumer price inflation (CPI) to target levels.

The BoE’s Monetary Policy Committee is expected to reiterate its “persistently” tough stance on the cost of borrowing by keeping its critical rate at a 15-year high of 5.25 per cent on Thursday.

UK headline inflation indicators such as CPI and data on wage increases are falling but leading policymakers are not jumping to conclusions that rates will be cut quickly. Deputy chief UK economist at Capital Economics Ruth Gregory says: “The evidence in the UK isn’t there for rate cuts in the near term.”

CPI levels in the US, the eurozone, Japan and China are also coming down after soaring during 2021 and 2022. However, energy prices remain stubbornly high by historical standards, particularly in Europe.

The European mortgage market has been pummelled by high interest rates and eurozone inflation, which reached a high of 4 per cent in September. The mortgage market is on course to grow only 1.5 per cent this year and 2.4 per cent in 2024, its slowest rate for a decade, compared with 4.9 per cent last year.

Meanwhile, in the US, Fed chair Jay Powell faces a tough balancing act ahead of the Federal Open Market Committee’s two-day rate-setting meeting, which begins tomorrow.

It looks likely that the Fed will hold interest rates at their 22-year high of 5.25-5.5 per cent despite a resilient labour market and solid consumer spending.

However, financial markets don’t seem to be buying Powell’s warnings that additional monetary tightening is still under consideration. Investors are convinced that incoming data will force the Fed to cut rates soon.

Constance Hunter, a senior adviser at MacroPolicy Perspectives, says: “[The Fed is] not going to go from tightening to easing and skip a neutral bias. What they would like to do is get to [that] stance as quickly as the inflation data will permit.”

Need to know: UK and Europe economy

The UK government is set to outline plans for a financial package to steady Northern Ireland’s public finances. Analysts have estimated that Northern Ireland, which is funded via a £15bn annual grant from the British government, needs at least £1bn extra this year.

Women account for only 19 per cent of FTSE 100 divisional heads, according to research by the Unilever, BP and Morgan Stanley International-backed 25×25 initiative. Currently, there are only nine female chief executives in the FTSE 100.

Shares in Belgian chemicals company Solvay fell 39 per cent today, leading losses on the regional Stoxx Europe 600 index, after the company successfully split off its composite materials unit. Shares in the composite materials unit, now renamed Syensqo, were up 8 per cent on their first day of trading.

Shares in German renewable energy company Encavis fell 5.3 per cent in early trade today, after Morgan Stanley cut its rating on the stock to underweight from equal-weight.

Need to know: Global economy

Warren Buffett-backed Occidental Petroleum has agreed to acquire CrownRock, one of the most sought-after private oil producers in the US shale patch, for $12bn. This follows ExxonMobil’s $60bn deal to buy Pioneer Natural Resources in October.

Russia’s state-owned Gazprombank has won South African approval to refurbish a refinery in the country, underlining how the bank has become a key channel for the Russian state to make energy investments abroad in the face of western sanctions.

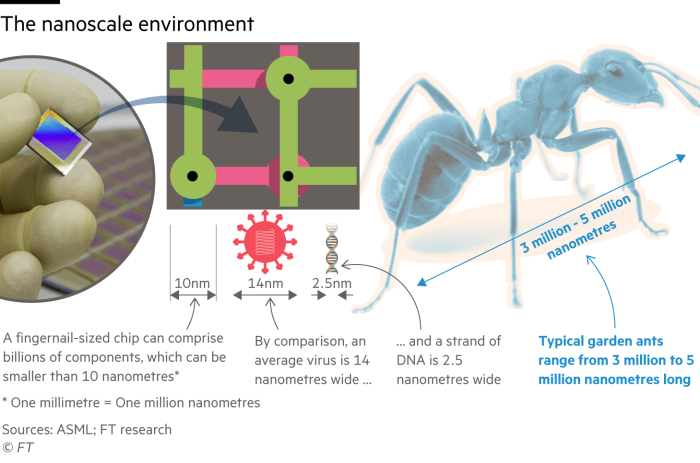

In a race to make “2 nanometre” processor chips, the world’s leading semiconductor companies are battling for dominance in the industry that pulled in well over $500bn in global chip sales last year. Further growth in sales is expected as demand for generative AI services increases.

Need to know: business

ByteDance-owned TikTok has agreed to invest $1.5bn in Tokopedia, the ecommerce unit of Indonesia technology group GoTo. Tokopedia will acquire TikTok Shop’s Indonesia business for $340mn.

Cigna, the US health insurer, has pulled out of plans to merge with Humana in what would have marked the largest deal of the year. Disagreements over financial arrangements, regulatory fears and falling share prices drove the decision, according to people familiar with the matter.

The World of Work

Michelin-starred chef Tom Kerridge spills the beans on how the magic of restaurants in reality requires “very, very hard work” ahead of the launch of the Butcher’s Tap & Grill in Chelsea.

Workplace psychotherapist Naomi Shragai speaks to the FT’s Miranda Green about the misguided mental banking of IOUs in the workplace. Doing favours can “build allies” but the expectation of reciprocity can seem “malevolent”.

Head of the FT’s Lex column Jonathan Guthrie reflects on his 37 years in financial journalism as he approaches retirement at the end of this year, including the valuable insight that “banks resemble supermarkets to the extent that blue whales resemble amoebas”.

Some good news

History enthusiasts in Northampton have located the buried remains of Collyweston Palace. The 15th century palace, which was owned by the grandmother of Henry VIII, Margaret Beaufort, was uncovered after the group raised £14,000 for the excavation.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you