Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

What are the prospects for the world’s still highly integrated economy? In answering this question, one has to start with the underlying forces at work.

The most fundamental are changes in economic opportunities. These include reductions in costs of transport and communications, shifts in comparative advantage and changing opportunities for exploiting economies of scale and learning by doing. No less crucial, particularly in the short and medium run, are changes in economic ideas and geopolitical realities. Finally, shocks — wars, crises and pandemics — also shift the perceptions of business, peoples and politicians of the risks, costs and benefits of cross-border integration.

The history of cross-border integration, especially trade, illuminates the interplay among these forces.

The long-term story is one of growing integration. Between 1840 and 2022, the ratio of world trade in goods to global output rose roughly fourfold. Yet openness to trade has fluctuated dramatically: the ratio of trade in goods to world output tripled between 1840 and 1913, then fell by roughly two-thirds between 1913 and 1945, and tripled again between 1945 and 1990, to surpass pre-1914 levels.

After the collapse of the Soviet Union and empire in the early 1990s, the world economy experienced two eras. The first, up to about 2010, was one of “hyperglobalisation”, a label applied by Arvind Subramanian and Martin Kessler in a 2013 paper for the Peterson Institute of International Economics.

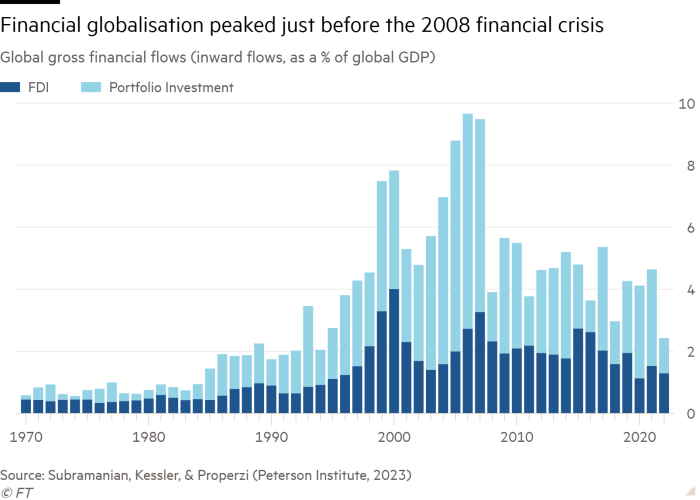

The dominant features were rapid growth of international transactions relative to global output, with flows of direct and portfolio capital across borders growing even faster than trade in goods and services. By the financial crisis of 2007-09, the world economy had become more integrated than ever.

Thereafter, the world economy entered an era some label “slowbalisation”. Subramaniam and Kessler (with Emanuele Properzi) have analysed this in a Peterson Institute piece of November 2023. In this period, trade has grown roughly in line with world output, while ratios of cross-border investment to world output have more than halved.

What caused pre-crisis hyperglobalisation? Why did it end in slowbalisation? What might happen next? The answer to the first question is that, after 1990, all three driving forces came together. First, close to one and a half centuries of divergent economic growth had created huge gaps in productivity between the most advanced economies and those that had fallen behind, notably China. This created enormous opportunities for taking advantage of cheap labour.

Second, the container ship, jumbo jet and advances in information and communication technology allowed unprecedented cross-border integration of business organisations and unbundling of supply chains. Finally, the worldwide shift towards belief in market liberalisation and cross-border opening transformed policy. Among the transformative moments were the arrival of Margaret Thatcher, Ronald Reagan and Deng Xiaoping to power in the UK, US and China, respectively. In world trade, highlights included completion of the Uruguay Round of multilateral negotiations in 1993, establishment of the EU single market in 1993, creation of the World Trade Organization in 1995 and China’s accession to the WTO in 2001.

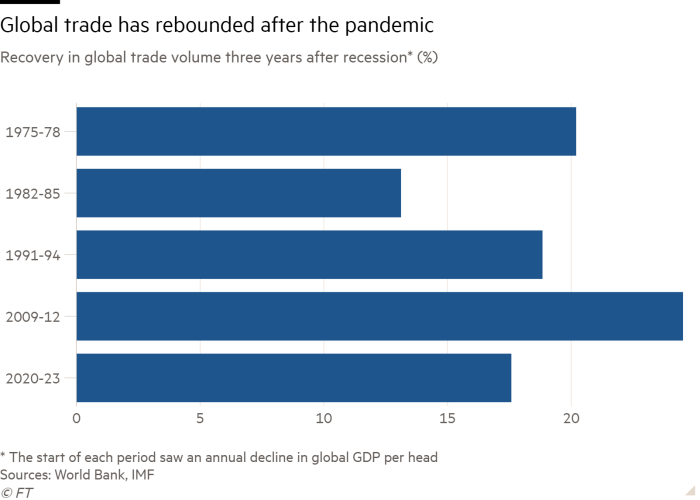

What ended this period? All the main drivers weakened or went into reverse. The opportunity for further trade increases through exploitation of differences in labour costs diminished, as those costs converged. As China’s economy grew, its dependence on trade naturally declined. Shocks caused by the pandemic and wars also underlined the risks associated with extensive reliance on trade for essential supplies.

At least as important have been ideological changes, among them the rise in protectionism and nationalism, notably in the US, triggered by the economic rise of China and the “China shock” to industrial employment. Parallel changes have occurred in Xi Jinping’s China. There, too, policy has shifted from reliance on the free market and private business towards greater government control.

Perhaps most important, the global financial crisis, pandemic and today’s great power tensions have transformed trust into suspicion and risk-taking into “de-risking”. No substantial global trade liberalisation has occurred in more than two decades.

What could come next? Continuation of a messy status quo seems the most plausible answer. The world economy would remain relatively open by historical standards with trade growing more or less in line with world output. Some decoupling of direct links between the US and China would occur. But the attempted shift by the US (and others) towards other suppliers would leave indirect dependence on inputs imported from China. A large number of countries would continue to maintain trade with the US and its close allies, on the one hand, and China, on the other.

The most likely alternative to this would be a more radical breakdown. Attempts to limit US actions against China over national security — Jake Sullivan’s “small yard and high fence” — might end up with a big yard and a high fence; Donald Trump winning the presidency might be the catalyst. Conflicts over the EU’s carbon border adjustment mechanism could be another trigger for global protectionism.

The integrated world economy is surviving. But great power nationalist rivalry can cause huge disruption. Will this era prove to be an exception? We must work to ensure it does.