European shares and US stock futures kicked off the month on a lacklustre note, as disappointing Chinese factory data muddled the economic outlook.

Following a rebound for beaten-down global equities in July, as markets responded to an economic slowdown by predicting high rates of inflation would ease, Europe’s regional Stoxx 600 share index was flat in early dealings on Monday.

Futures trading suggested Wall Street’s blue-chip S&P 500 equity index would fall 0.3 per cent at the New York opening bell.

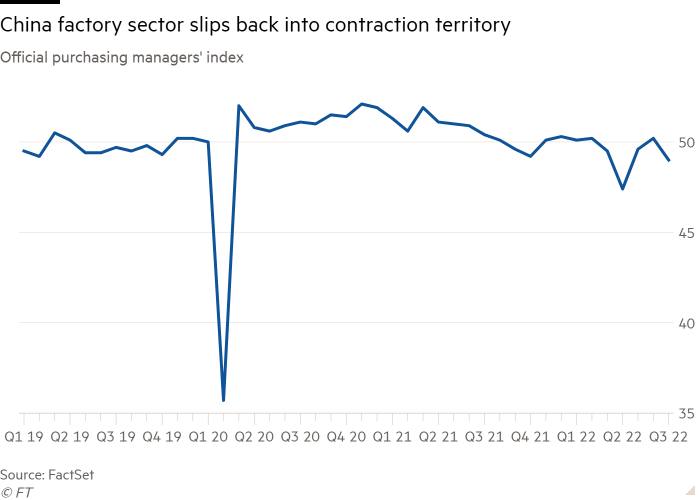

Official data released at the weekend showed Chinese factory activity contracted unexpectedly last month after new coronavirus flare-ups and stress in the nation’s property market weakened demand. The purchasing managers’ index for the manufacturing sector produced a reading of 49, down from 50.2 in June and below the threshold of 50 that separates expansion from contraction.

“Both domestic demand and external demand for manufacturing were weak,” ING greater China economist Iris Pang said in a note to clients.

“Uncompleted real estate projects could be at least part of the reason,” Pang added, after indebted developers suspended construction of millions of apartments. Pang also cited a “risk of contagion from financially unhealthy property developers to their downstream and upstream industries.”

Later on Monday, the closely watched ISM manufacturing PMI is expected to show a slowing of growth in US activity, with economists polled by Reuters predicting a reading of 52 in July from 53 the previous month.

Investors remain uncertain, however, on whether heightened recession risks will dent stock prices by weighing on corporate earnings or boost expectations that surging global inflation will peak, prompting central banks to turn cautious over future rate rises.

Markets are “looking beyond the well-known inflation issue and what they see as a slowdown which will force central banks to ease again”, said Antonio Cavarero, head of investments at Generali Insurance Asset Management.

“A bit of caution is needed though, as next quarter’s earnings might not keep the pace of the current market enthusiasm.”

In government debt markets, the yield on the benchmark 10-year Treasury note added 0.03 percentage points to 2.67 per cent as the price of the instrument fell. This followed a strong rally for government debt last week after data showed the US economy had contracted for the second consecutive quarter.

While the Federal Reserve raised its main interest rate by 0.75 percentage points to a range of 2.25 to 2.5 per cent last week, futures markets are now pricing a peak fed funds rate of about 3.3 per cent in early 2023, with rate cuts thereafter.

Germany’s 10-year Bund yield was steady at 0.83 per cent, with the barometer of eurozone debt costs down sharply after topping 1.9 per cent in June.

Brent crude, the oil benchmark, slipped 0.5 per cent lower to $103.42 a barrel.