On-chain data shows the Bitcoin taker buy sell ratio has surged up to a high not seen since almost two years ago.

Bitcoin Taker Buy Sell Ratio Observes Uplift In Recent Days

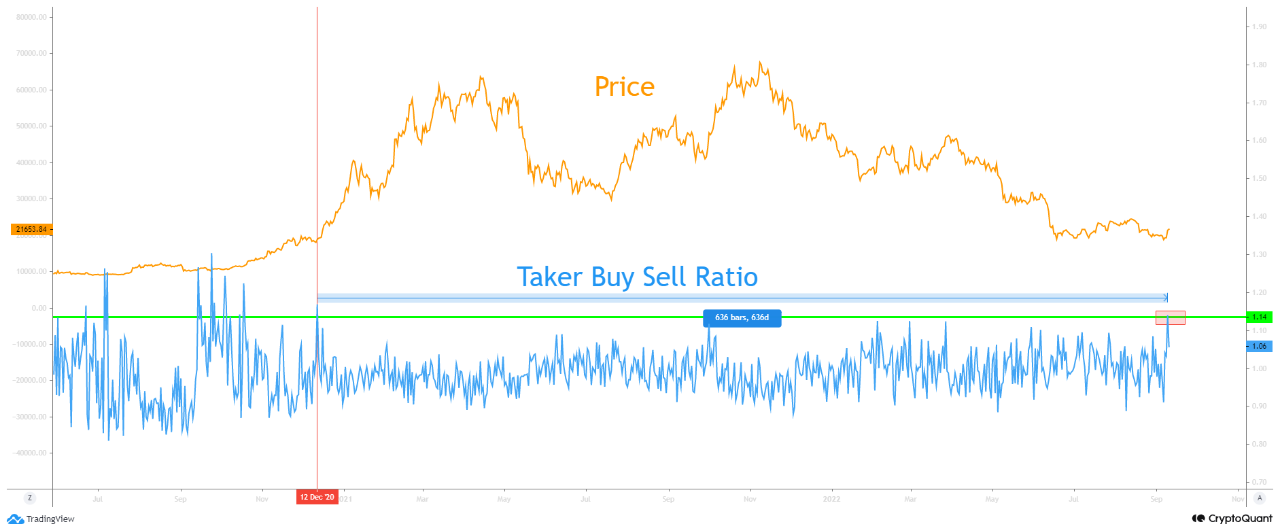

As pointed out by an analyst in a CryptoQuant post, the taker buy sell ratio is now at its highest value in 636 days.

The “taker buy sell ratio,” as its name suggests, is an indicator that measures the ratio between the taker buy volumes and the taker sell volumes.

When the value of this metric is greater than one, it means the long volume is overwhelming the short volume right now. Such a trend suggests that a bullish sentiment is more dominant in the market currently.

On the other hand, the ratio being below this threshold implies taker sell volume is higher at the moment. This trend naturally hints that the market holds a bearish majority sentiment.

Now, here is a chart that shows the trend in the Bitcoin taker buy sell ratio over the last couple of years:

The value of the metric seems to have surged up in recent days | Source: CryptoQuant

As you can see in the above graph, the Bitcoin taker buy sell ratio observed a spike in its value just recently.

During this sudden increase, the indicator hit a high of 1.14, a value that it hasn’t seen since around 636 days ago.

Since these latest values are higher than the “1” mark, the taker buy volumes are currently more dominant in the market.

Incidentally, the last time these highs were seen was just before the 2021 bull run started. If a similar trend follows this time as well, then the current Bitcoin taker buy sell ratio values can prove to be bullish for the crypto’s price.

BTC Price

At the time of writing, Bitcoin’s price floats around $21.5k, up 9% in the last seven days. Over the past month, the crypto has lost 10% in value.

The below chart shows the trend in the price of the coin over the last five days.

Looks like the value of the crypto has observed upwards momentum during the past couple of days | Source: BTCUSD on TradingView

After plunging down hard just two weeks ago, Bitcoin has seen some sharp recovery in the last few days as the crypto has regained the $21k level.

Currently, it’s unclear whether this recovery will last, or if the coin will see a retrace soon. However, as mentioned before, if the taker buy sell ratio is anything to go by, then BTC may see a bullish outcome.

Featured image from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, CryptoQuant.com