UK government bonds sold off sharply and the pound hit a new 37-year low against the dollar as investors braced themselves for a flood of debt sales to fund chancellor Kwasi Kwarteng’s tax cuts and energy subsidies.

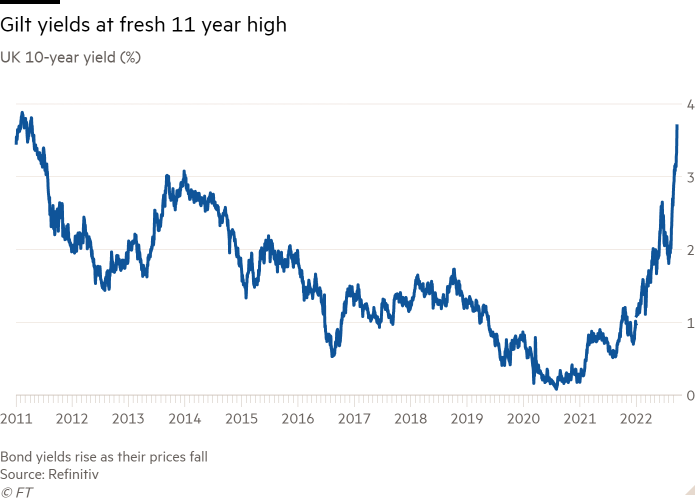

The 10-year gilt yield surged more than 0.2 percentage points on Friday to 3.7 per cent, bringing its rise for the week to more than half a percentage point. It marks one of the biggest increases in long-term borrowing costs on record. Sterling fell below $1.11 for the first time since 1985.

Friday’s heavy selling in gilts and the pound came after Kwarteng said the government would scrap the 45p top rate of income tax, replacing it with a 40p rate. He also announced a cut in stamp duty on home sales.

The tax cuts, which will reduce government income, come as the UK is expected to spend £150bn on subsidising energy costs for consumers and businesses. Kwarteng said the energy rescue scheme would cost £60bn in its first six months.

A large swath of this borrowing will need to be financed by selling gilts. The UK Debt Management Office increased its planned bond sales for the 2022-23 fiscal year by £62.4bn to £193.9bn.

“This is an escalation of the dramatic sell-off we’ve already seen in the gilt market over the past two months,” said Antoine Bouvet, a fixed-income strategist at ING. “There are a lot of tax cuts coming on top of the energy price guarantee, and that’s scaring gilt investors who now see a tonne more issuance coming.”

Bouvet said markets were also anticipating more aggressive interest rate rises from the Bank of England to offset the inflationary impact of Kwarteng’s stimulus measures, following a 0.5 percentage point increase in the bank rate this week. The expectations for more aggressive BoE rate increases sent the two-year gilt yield soaring more than 0.8 percentage points higher this week.

Following the chancellor’s announcement, markets were pricing in 0.75 percentage point rises at each of the next three BoE meetings, taking rates to 4.5 per cent.

The prospect of sharply higher interest rates did little to support the pound, which slumped to a fresh 37-year low against the dollar on Friday. Sterling fell as much as 1.6 per cent after Kwarteng spoke, hitting a low of $1.1078, a level last seen in 1985, according to Refinitiv data.

The decline came as the dollar continued its rally against currencies across the globe, two days after the Federal Reserve lifted its interest rate by 0.75 percentage points for the third consecutive meeting as it attempts to tame soaring inflation. Against the euro, the pound fell 0.6 per cent.

“In this type of environment with the cost of living crisis, energy crisis . . . the chance for policy missteps rises,” said Stephen Gallo, head of European FX at BMO Capital Markets. “The currency is going to show a lot of the burden and it is doing that now.”