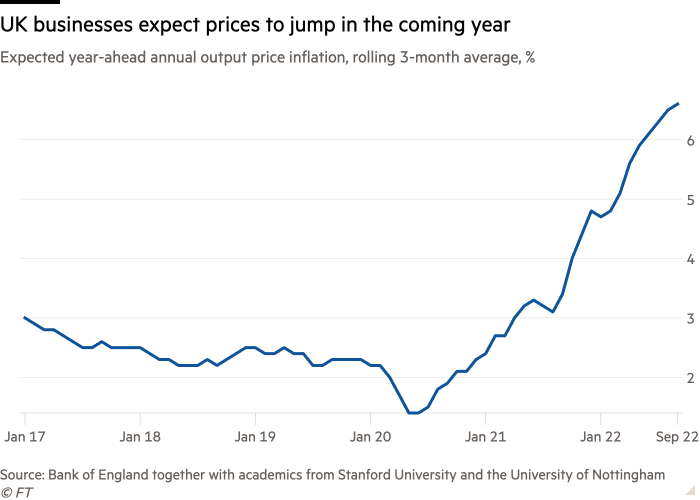

UK businesses expect to raise their prices at the fastest pace since records began to offset higher wage costs driven by a tight labour market, according to an influential survey by the Bank of England.

Business leaders in the central bank’s decision maker panel forecast in September that they would increase prices by 6.6 per cent in the year ahead, up from 6.5 per cent in August, the highest since the survey began in 2017.

The findings confirm BoE concerns “that firms are finding it too easy to pass higher costs on to consumers”, said Simon Harvey, head of foreign exchange analysis at Monex Europe, a foreign exchange company.

He noted that these worries have contributed to the central bank raising rates by 100 basis points at its past two monetary policy meetings.

The monthly survey of chief financial officers from small, medium and large UK businesses is used by the BoE to monitor developments in the economy and supports the case for interest rate rises at the November 3 meeting of the bank’s Monetary Policy Committee.

Markets are currently pricing in a combined 100 basis point increase on the current 2.25 per cent rate as the bank battles to rein in UK inflation, which is at a near 40-year high. Interest rates are expected to rise to 5.7 per cent by June next year, according to market expectations.

The survey revealed that business leaders predict inflation will hit 4.8 per cent in the medium term, up from 4.2 per cent in the previous month’s survey.

Harvey noted that the more hawkish members of the MPC will consider this “de-anchoring of medium-term inflation expectations as particularly concerning”.

Businesses also expect wages to increase by a record 5.9 per cent in the year ahead, up from 5.5 per cent in August. They reported that wages were already rising by 6.5 per cent in September, a full percentage point higher than in July.

Some 84 per cent reported they were finding it harder than usual to recruit new employees, down only marginally from 86 per cent in August.

The level of overall business uncertainty also increased, with more than two-thirds of respondents reporting that concern for their business was “high” or “very high”, 6 percentage points higher than in August. Businesses are less likely to invest in periods of high uncertainty, which could limit growth.

In a separate survey of 5,200 firms conducted by the British Chambers of Commerce, close to 40 per cent of businesses warned that they expected their profits to fall in the next 12 months. This is the worst level since the height of the Covid crisis in 2020.

Only a third of firms reported increased domestic sales, down from 41 per cent last quarter, while more than four in five firms said inflation remained a growing concern. Almost two-thirds expected their own prices to rise over the coming months.

The BCC said the survey, conducted before the government’s energy support package for firms and its mini-Budget, showed weakening structural business conditions and confidence from the second quarter.

One in three firms reported reduced cash flow over the last three months, while less than half expected their turnover to increase over the next 12 months. The outlook was particularly bleak for the retail and wholesale sector, which is in its second quarter of negative territory, the BCC said.

Shevaun Haviland, BCC director-general, said the findings “paint a worrying picture of the state of affairs at many UK firms”.

“Some firms are telling us that they have been forced to cancel otherwise viable projects due to soaring costs,” she said. “The current volatility in the financial and currency markets must be speedily addressed to return stability to the economy and give business some certainty to plan.”

Separate data published by S&P Global/Cips on Thursday showed that activity in the construction sector improved in September, with the output index rising to 52.3 in September, up from 49.2 in August.

However, Tim Moore, economics director at S&P Global Market Intelligence, which compiles the survey, cautioned that the modest increase in business activity “was fuelled by delayed projects and easing supply shortages rather than a flurry of new orders”.

“Forward-looking survey indicators took another turn for the worse in September, with new business volumes stalling and output growth expectations for the year ahead now the lowest since July 2020,” he said.