US Treasuries registered their best week in a year, as investors shrugged off the highest inflation rate since 2008 and piled into government debt.

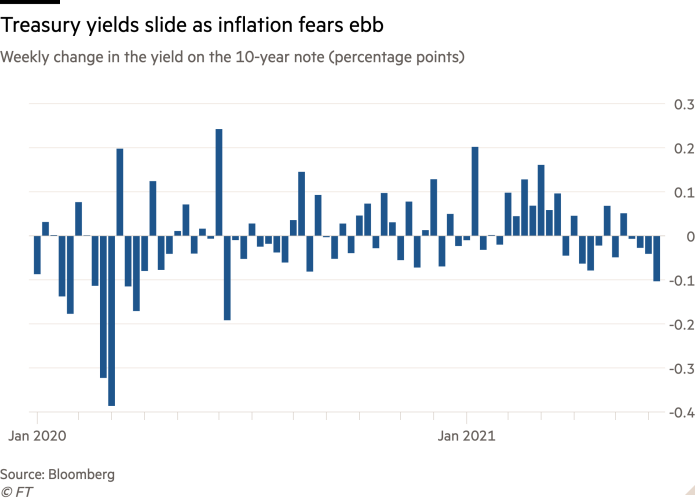

The benchmark yield on the 10-year Treasury note fell by 0.103 percentage points to 1.45 per cent, notching its largest weekly decline since June last year.

The move has been propelled by declining inflation expectations. The 10 year break-even inflation rate has fallen 0.08 percentage points to 2.34 per cent this week.

That cooling of expectations for longer-term inflation has happened despite data on Thursday that showed the year-on-year increase in US consumer prices leapt to 5 per cent in June.

That suggests a growing willingness among investors to accept the Federal Reserve’s mantra that higher inflation will prove transitory, settling down once the comparisons to last year’s locked-down economy have run their course.

The 10-year Treasury yield sank 0.06 percentage points on Thursday, before retracing 0.02 percentage points on Friday.

There has been a sharp shift in the world’s largest government bond market over the past month. Ten-year inflation expectations hit their highest level since 2013 in early May, and the 10-year Treasury yielded 1.70 per cent at that point. Many fund managers had bet the Fed would have to respond to the inflation spurt by scaling back its monetary stimulus soon, tapering purchases of Treasuries and government-backed mortgages that currently run to $120bn a month.

“Last month people were looking at the pick-up in inflation and thinking central banks can’t possibly just stand by and not do anything,” said Andrea Iannelli, investment director at Fidelity International. “But investors are waking up to the fact that actually that’s exactly what they’re going to do.”

Analysts say the recent rally has been further fuelled by a short squeeze, as investors who placed bets against Treasuries earlier in the year were forced to throw in the towel when the market moved against them.

Despite the buying this week, many investors still hold short positions, suggesting the squeeze could continue and yields could drop further, according to Ian Lyngen, head of US rates strategy at BMO Capital Markets.

A client survey by BMO last week found a record 71 per cent of investors thought the next substantial move in Treasury yields would be upwards. “We’ve fielded a variety of queries along the lines of ‘how long are the current distortions going to last?’” Lyngen said.

Others expect that it is this week’s Treasury rally that will prove transitory, and inflation will not.

In that environment, the Fed will soon have to begin the process of softening up markets for a slowing of bond purchases, possibly as soon as its meeting next week, according to Oliver Jones of Capital Economics.

The recent rally “may just be a pause for breath after a historically rapid sell-off” in the first quarter of the year, he said. “We doubt that it will last.”

Unhedged — Markets, finance and strong opinion

Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here to get the newsletter sent straight to your inbox every weekday