Purchasing a home in New York marks a monumental step, unveiling a rich tapestry of choices across its dynamic neighborhoods and bustling boroughs. From the historic allure of homes in Manhattan to the suburbs of Syracuse, the city offers an array of possibilities for novice and seasoned buyers. The journey to homeownership here is as diverse as the city itself. This Redfin article will delve into the intricacies of buying a house in New York, guiding you through this vibrant and fast-paced market. So get ready to embark on your home buying journey in New York.

What’s it like to live in New York?

Living in New York offers a mosaic of experiences beyond the iconic cityscape of NYC. Picture the serene beauty of the Finger Lakes region, where vineyards sprawl and pristine lakes shimmer against a backdrop of rolling hills. Upstate New York offers plenty of outdoor adventures, from hiking the Adirondack High Peaks to skiing in the Catskills. However, life in the state also comes with contrasts like extreme weather and high taxes. Check out this article to learn more about the pros and cons of living in New York.

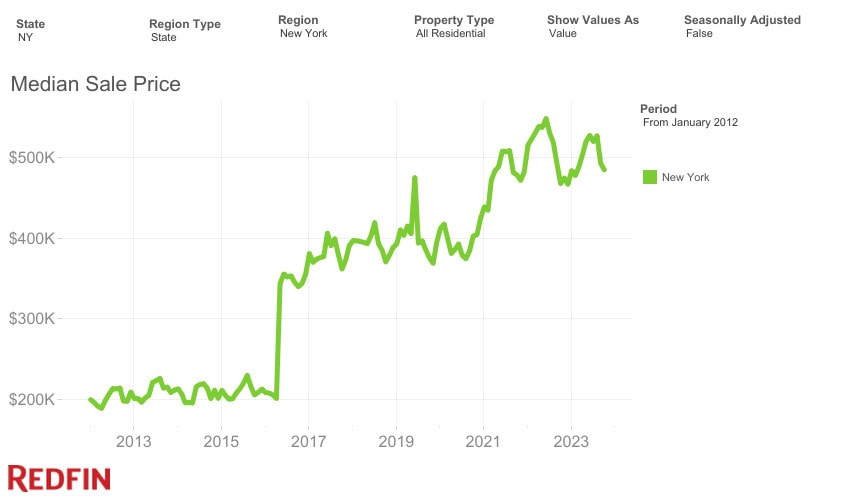

New York housing market insights

The housing market in New York reflects a diverse landscape with varying trends across its regions. The state’s median sale price is higher than the national average of $413,944, standing at $484,300, showcasing its premium real estate positioning. In the heart of New York City, the median sale price skyrockets to $764,000, illustrating the immense cost of urban living in one of the world’s most sought-after metropolises. The New York housing market is also experiencing a decline in the number of homes available for sale, down by 10.9% year-over-year. Cities like East Rochester, Greece, and East Glenville emerge as competitive hotspots, contributing to an environment where securing property can be fiercely competitive.

Finding your perfect location in New York

Selecting the ideal location when purchasing a home in New York holds immense significance, shaping both your lifestyle and investment. Your chosen location determines the physical environment and factors like community dynamics, access to outdoor activities, local amenities, and even property taxes. Whether aiming for a rural escape, suburban comfort, or city-centric living, pinpointing the right spot aligns your aspirations with the area’s unique offerings. Exploring affordable places to live in New York can be easier with tools like a cost of living calculator. These tools can help you find a city that suits your lifestyle and fits your budget. Begin your journey by learning about these five popular cities.

#1: Rochester, NY

Median home price: $160,000

Rochester, NY, homes for sale

Living in Rochester boasts a mix of history and innovation, embodying resilience and forward-thinking. It’s a city where diverse neighborhoods like the Neighborhood of the Arts and Park Avenue each have their own unique character. The Genesee River provides scenic walks, while the Lilac Festival and George Eastman Museum highlight the city’s cultural richness.

#2: Buffalo, NY

Median home price: $190,250

Buffalo, NY, homes for sale

The cost of living in Buffalo is 9% lower than in Albany, making it a perfect place to consider on your homebuying journey. Moving to Buffalo will open the door to a unique blend of history, community, and opportunity. Residents enjoy a diverse cultural scene, from architectural wonders like Frank Lloyd Wright’s Darwin D. Martin House to the Albright-Knox Art Gallery’s world-class exhibitions. The city’s affordability to other New York locales allows for a comfortable lifestyle.

#3: Albany, NY

Median home price: $250,000

Albany, NY, homes for sale

The state’s capital, Albany, has a rich past that merges seamlessly with a contemporary lifestyle. The city thrives as a hub of governmental activity, fostering a unique blend of cultural diversity. Albany embraces its heritage, which is evident in sites like the New York State Museum, while offering a thriving arts scene with galleries and theaters. Living in Albany means residents can enjoy a balance of urban amenities and scenic landscapes, with the nearby Adirondacks and Hudson River providing ample outdoor escapades.

#4: White Plains, NY

Median home price: $630,000

White Plains, NY, homes for sale

Nestled in Westchester County, living in White Plains offers a balanced lifestyle, blending the tranquility of suburban neighborhoods with the convenience of city amenities. Residents revel in the vibrant downtown scene, boasting diverse dining options, upscale boutiques, and cultural attractions like the ArtsWestchester Gallery. The city’s green spaces, such as Tibbetts Brook Park and the Silver Lake Preserve, offer serene retreats for outdoor enthusiasts.

#5: New York City, NY

Median home price: $762,500

New York City, NY, homes for sale

Living in New York City is a fast-paced, diverse experience. It’s a place where cultures collide, from the aromatic street food scene in Queens to the vibrant art galleries in Chelsea. Central Park offers an oasis amidst the towering skyline, a sprawling green haven amid the urban jungle, while Broadway dazzles with its world-renowned shows. Despite its myriad attractions, the city’s allure comes with a hefty price tag. For instance, the cost of living in Manhattan alone is 127% higher than the national average. This translates to elevated housing, groceries, transportation, and entertainment expenses, making it crucial to navigate the city’s pulse while balancing the budget.

The homebuying process in New York

Once you’ve discovered your ideal location, it’s time to consider purchasing your new home. We’ll guide you through all the essential information to kick-start your journey toward homeownership in The Big Apple.

1. Prioritize your finances

Prioritizing your finances is critical when purchasing a house in New York. Start by assessing your overall budget and long-term financial goals. Using resources such as an affordability calculator can assist in gauging the comfortable range for your home purchase. It factors crucial elements like your income, debts, and potential mortgage rates, ensuring a responsible and sustainable investment.

Various programs are available for first-time homebuyers in New York, including the Homebuyer Dream Program (HDP), which offers up to $14,500 in down payment and closing cost assistance.

2. Get pre-approved for a mortgage

In New York, securing pre-approval for a mortgage involves collaborating with a lender who evaluates your financial situation, creditworthiness, and income. This procedure results in a pre-approval letter, bolstering your credibility as a committed buyer and establishing a definitive budget for your house search.

3. Connect with a local agent in New York

A New York real estate agent has extensive knowledge covering everything from understanding local market trends and neighborhood dynamics to navigating legal complexities. This expertise ensures you can make informed decisions and seamlessly navigate the real estate process. So whether you need a real estate agent in Albany or an agent in Manhattan, they’re here to help.

4. Start touring homes

Touring homes play a pivotal role in the homebuying process as it offers a firsthand experience and deeper insight into a property beyond what listings or photos can convey. It’s a chance to physically explore the layout, assess the condition, and visualize living in the space.

5. Make the offer

Making an offer requires careful consideration of various factors, such as the property’s market value, condition, and current market conditions. To make a compelling offer, you should collaborate with your real estate agent to determine a competitive yet reasonable price and consider comparable sales.

6. Close on the house

The final step of the homebuying process in New York is the closing process. This intricate process involves several crucial steps, including a final property review, signing the necessary legal documents, and settling financial matters.

To give you more insight into the homebuying process, check out Redfin’s First-Time Homebuyer Guide.

Factors to consider when buying a house in New York

Before you jump into your homebuying journey, you’ll want to consider several factors before buying a house in New York.

Diverse housing options

New York offers diverse housing options, from historic brownstones and pre-war buildings to modern high-rises and co-op apartments. Each property type may have its unique ownership structure, fees, and regulations, requiring thorough research before purchasing.

Property taxes

New York’s property tax rates are notably high compared to many other states in the U.S., often ranking among the highest in the nation. The state’s tax burden on property owners can be significant, with rates varying across different regions but generally representing a substantial expense for homeowners. The statewide average rate is 1.62%, while the average is 0.99%.

Dual agency

In New York, dual agency occurs when one agent represents both the buyer and seller in a real estate transaction. Assessing comfort levels with this setup is essential for both buyers and sellers. They need to verify that the dual agent upholds transparency and professionalism throughout the entire transaction.

Buying a house in New York: Bottom line

Buying a house in New York is a unique and multifaceted journey that demands careful consideration of various factors. The process is marked by challenges and opportunities, from navigating the competitive market and high property taxes to embracing the diverse neighborhoods and legal intricacies.

Buying a house in New York FAQs

How much money do you need to buy a house in New York?

The money needed to buy a house in New York varies significantly based on multiple factors, including the property’s location, size, condition, and the buyer’s financial situation. New York state has a median sale price of 484,300. Generally, buyers should consider costs such as the down payment (typically ranging from 10% to 20% of the home’s purchase price), closing costs (around 2% to 5% of the purchase price), property taxes, homeowner’s insurance, and potential additional expenses for inspections, appraisals, and moving costs. In New York, where real estate prices can be higher than the national average, having a substantial savings fund is advisable to cover these costs and to secure a mortgage with favorable terms.

What’s the typical down payment required when purchasing a house in New York?

The typical down payment required when purchasing a house in New York usually falls between 10% to 20% of the home’s purchase price. This range translates to the buyer’s substantial initial payment upon signing the purchase agreement. However, the exact amount needed can vary based on factors such as the type of mortgage, individual lender requirements, the buyer’s credit history, and the overall cost of the property. Specific loan programs might offer lower down payment options, potentially requiring as little as 3% to 5% down, but these programs often come with specific eligibility criteria.

Is it worth buying a house in New York?

Whether to buy a house in New York depends on various factors, including personal preferences, financial considerations, and long-term plans. New York offers diverse neighborhoods, cultural richness, and career opportunities, especially in cities like New York City, Buffalo, or Albany. However, the state also comes with a high cost of living, elevated property prices, and high property taxes, particularly in certain areas. Assessing affordability, job stability, desired lifestyle, and housing market trends is crucial.