This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

The European Central Bank and Bank of England have refused to declare victory over inflation. Policymakers yesterday signalled that interest rates would need to remain higher for longer, diverging from the US Federal Reserve.

The ECB and BoE announcements damped a market rally sparked by the Fed, which indicated it would cut rates next year.

Christine Lagarde, ECB president, warned there was still “work to be done” to tame price pressures after leaving interest rates unchanged, as she pushed back against market expectations for the central bank to cut rates as early as March.

“We should absolutely not lower our guard” against inflationary pressures, she said, even as the ECB cut its inflation forecasts for this year and 2024.

Later in the day, the BoE voted by six to three to hold rates at 5.25 per cent, as the Monetary Policy Committee warned it was confronting a more stubborn problem with inflation than its counterparts across the Atlantic.

The announcements came just hours after the Fed held interest rates at a 22-year high of 5.25 per cent to 5.5 per cent and provided forecasts showing US officials believe rates will end next year at 4.5 per cent to 4.75 per cent.

US officials expect rates to fall even lower in 2025, with most forecasting they would end up between 3.5 per cent and 3.75 per cent.

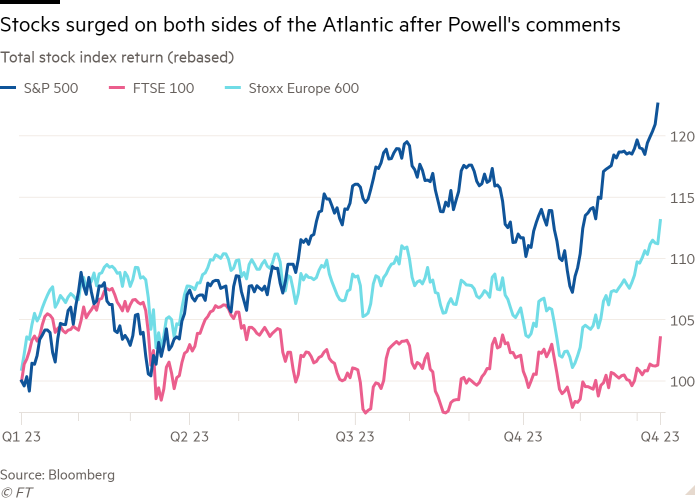

The Fed’s projections triggered a rally in US stocks and a sharp fall in Treasury yields. The benchmark S&P 500 gained 1.4 per cent to close Wednesday at its highest level since January 2022, while the two-year Treasury yield fell 0.3 percentage points to 4.43 per cent — its biggest daily decline since the collapse of Silicon Valley Bank in March.

The benchmark 10-year Treasury yield also fell 0.17 percentage points on Wednesday and dropped further during Asia morning trading to sit below 4 per cent for the first time since August.

But the more hawkish stance from the BoE and ECB sapped the life out of the rally. The region-wide Stoxx Europe 600 rose 0.9 per cent, led higher by big gains for rate-sensitive real estate stocks. London’s FTSE 100 added 1.3 per cent, while France’s Cac 40 rose 0.6 per cent, falling just short of an all-time closing high.

Despite the divergence, investors bet that the ECB and BoE will follow the Fed in signalling cuts to borrowing costs in 2024.

“Major central banks can deviate from the Fed in principle, but doing so in a significant way for an extended period historically has been difficult to do,” said Nathan Sheets, a former US Treasury official.

Need to know: UK and European economy

UK business activity rose at the fastest pace in six months in December, according to a closely watched survey. The results were ahead of expectations and eased fears that the UK economy would contract in the final quarter of this year.

Eurozone business activity declined at a steeper rate than anticipated this month, according to the flash S&P Global composite purchasing managers’ index, dealing another blow to the region’s struggling economy. The index fell to a two-month low of 47, down from 47.6 a month earlier, after activity contracted in both the services and manufacturing sectors.

The EU is set to extend its truce with the US over steel tariffs imposed by Donald Trump until after the 2024 presidential election. European trade commissioner Valdis Dombrovskis told the Financial Times he was in favour of postponing the reimposition of retaliatory tariffs on goods such as bourbon whiskey and Harley-Davidson motorbikes. Washington had also agreed to suspend its levy on steel and aluminium.

The UK government has signalled it will not step in to help France’s EDF fund Britain’s flagship nuclear power project. The Hinkley Point C project is likely to exceed the revised £32.7bn estimate EDF put on it earlier this year after its Chinese partner CGN halted payments to cover mounting cost overruns.

UK consumer confidence in December rose to its highest level since September and the second-highest since January 2022, according to research company GfK, suggesting households could be more inclined to spend this Christmas.

Poland’s newly appointed Prime Minister Donald Tusk on Friday pledged to secure billions in funding that was frozen by Brussels during Warsaw’s previous administration over concerns about the rule of law in the country. Tusk added that €5bn of EU funding already released amounted to “a Christmas present” that would “improve our energy sovereignty”.

Need to know: global economy

Industrial output in China rose 6.6 per cent year on year in November, while retail sales came in lower than expected, rising 10.1 per cent. The increases from a low base failed to dispel doubts about the growth prospects of the world’s second-biggest economy.

The price of carbon fell to its lowest level in 14 months yesterday, briefly slumping as much as 4 per cent in London to below €66 per tonne of carbon emissions. Traders appear unconvinced that the agreement struck at the COP28 summit will lead to meaningful government action on the climate.

Vladimir Putin’s war in Ukraine is putting “considerable strain” on Russia’s economy, driving up domestic consumer prices and forcing Moscow to spend a third of its budget on defence, the US Treasury department has said.

Need to know: business

St James’s Place is planning to raise up to £1bn by 2030 to buy the businesses of retiring partners, as it tackles challenges wrought by its increasing scale and higher interest rates.

Munich prosecutors have charged Wirecard’s former chief financial officer, Burkhard Ley, with fraud, breach of trust, accounting and market manipulation more than three years after the payments company collapsed in one of Germany’s biggest corporate scandals.

Apollo, Carlyle and KKR are studying separate bids for Pension Insurance Corporation ahead of a deadline this week, as big private capital groups look for a way into the thriving market for UK corporate pension deals.

US social media giant Meta has been forced to apologise publicly to Qatari billionaire (and Janet Jackson’s former husband) Wissam al Mana and promise extra protection after his image was used in crypto scam advertisements on Facebook.

Science round-up

Teams of bacteria in the gut help fight disease by eating invading pathogens’ lunch, according to research that underscores the health benefits of fostering humans’ rich digestive ecology.

A pill that has the potential to treat the most common and deadly cancers will begin human clinical trials next month, Belfast-based CV6 Therapeutics announced yesterday, in a milestone for Northern Ireland’s growing life sciences industry.

Scientists have combined brain-like tissue with electronic hardware to create a speech-recognition and calculation system, advancing research into the creation of high-powered biological computers.

Some good news

The scimitar-horned oryx, a type of antelope that was declared extinct in the wild in 2000, was downlisted to endangered on Wednesday. The species is roaming Chad again after conservationists reintroduced it using captive animals.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you